Financial Review - How are you tracking in FY 22/23?

December is often a busy time for many businesses as they prepare to either wind up the calendar year and take some time off over Summer and enjoy the festivities or, get ready to tackle their busiest time of year.

Either way, one activity that should not be overlooked this month is reviewing your financial year to date progress.

The 31st of December marks the six month point of the financial year and this is the perfect time to evaluate how you are tracking with your business goals.

When it comes to reviewing your financial goals, there’s more to review than just sales. If you want to gain a comprehensive understanding at how you are tracking against your budget, we also recommend reviewing your major expense lines and then your overall profit.

If you have not prepared a budget for the financial year, then here are three high-level metrics to review:

Sales – year on year

When assessing your sales, compare them to the previous year. Are they higher or lower? If your sales are higher, then what percentage are they higher? To do this, divide this year’s sales by last year’s sales.

If you can, provide some commentary around why you think sales may be different to last year. Have you increased / decreased your marketing? Are there economic factors at play that might affect your sales? Understanding why there is a variance can help you make decisions for next year’s planning.

Major expense categories

How do your major expense categories like wages and materials/COGS compare to last year? Are they higher or lower? Once again, divide this year’s result by last year’s results to calculate your percentage increase or decrease. Then review if this variance in line with the increase or decrease in sales.

Profitability

Once you have compared the sales and expenses and their variances, you can calculate the difference in profit.

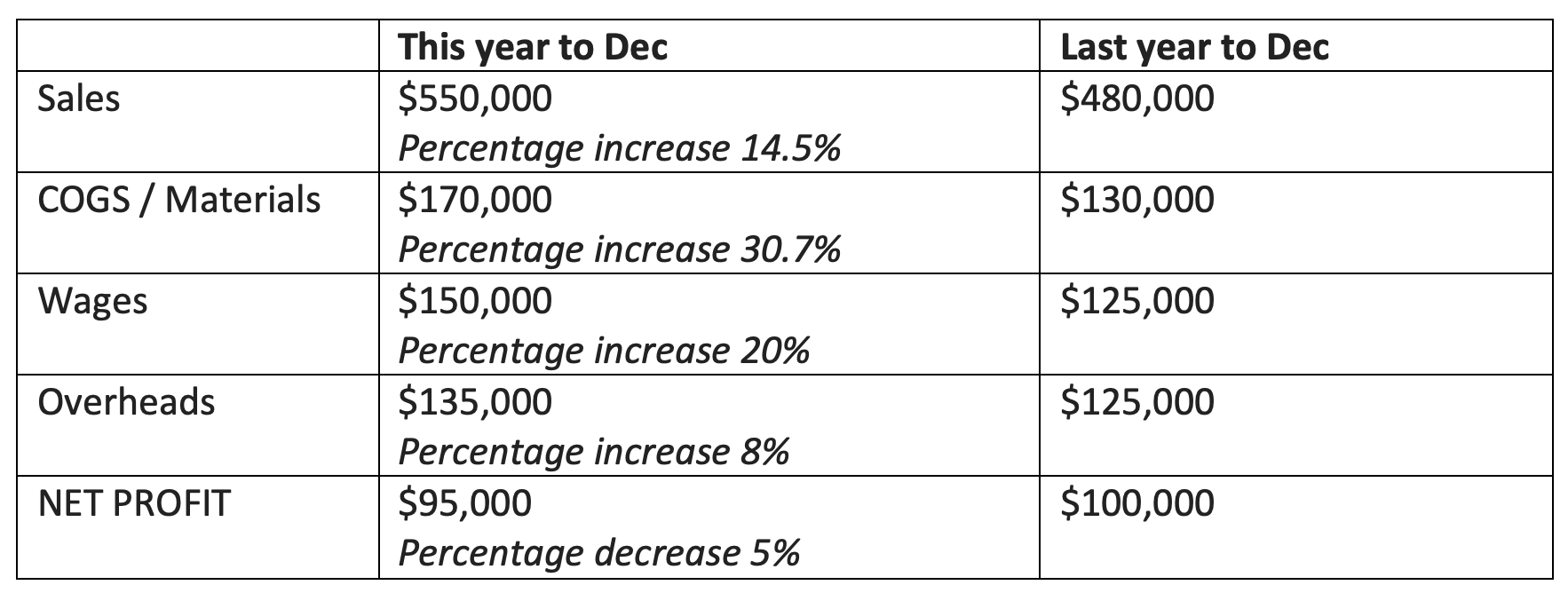

The review points can be illustrated in the example below:

In the example above, if you just compared sales this year versus sales last year, then it appears that this business has had a very good six months as it is up 14.5% on last year.

However, when you drill down, costs have actually risen faster than sales and this has resulted in a lower profit than last year.

In a high inflation environment, it is vital to regularly review all factors of your business, not just sales. It might feel like you are working harder and perceive that you are achieving more, however, it could be the case that you are actually working harder for less.

Our team love helping our clients to review and forecast their numbers each month or quarter to ensure they are informed about their financial status. If you’d also like to benefit from our advice for growth, please contact one of our team at admin@wrightsca.com.au.

Important notice: This article provides information rather than financial advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information.