FAQ

As a business, how do I get out of paying tax?

It's simple, if you don't want to pay tax, then don't make a profit. Paying tax means your business is profitable. We have a comprehensive understanding of small business tax concessions and tax law. We can certainly help you minimise tax, however our advisory services help businesses to become profitable so paying tax is just part and parcel of that result.

How can I save on tax?

There are many ways in which you can save on tax. Organise a consultation with one of our accountants to look into your individual circumstances.

How much can I sell my business for?

Typically business will sell between 1 and 7 x profit. As a general rule, the businesses that sell for 1 x profit are the ones that are only generating a wage for the owner and little to no additional profit.

In general, the businesses that are selling for 7 x profit are the ones where they are not key person dependent. Typically these businesses have built a loyal customer base as well as diligently increased their sales and price elasticity by building a brand. They will generally have a low staff turnover and a high level of staff engagement. Their systems and processes are world class and financially, they are highly profitable.

Mostly, we see businesses sell regionally between 1 and 3 x their profit.

As a business owner, do I need to declare all of my income?

Yes you do. The income that you need to declare each financial year includes:

- Employment income

- Super pensions, annuities and government payments

- Investment income (including rent, interest, dividends and capital gains tax)

- Business, Partnership and Trust income

- Foreign income

- Crowdsourcing

- Activity through a digital platform (such as a website or an app) where people share assets or services for a fee e.g. Uber, Airbnb etc.

- Other income such as insurance and compensation payouts, money received via prizes and awards, income from rendering personal services and ATO interests, remissions or recoupment.

As a director, am I liable for any of my company ATO debts?

Company directors are legally responsible for their company meeting its PAYG withholding obligations. They are liable for a penalty if they fail to withhold or pay a pay-as-you-go (PAYG) withholding amount when required. For example; if you withhold from payments made to employees, directors, office holders or other individuals in various capacities.

The penalty imposed is equal to the amount that you should have withheld or paid.

Do I need to register for GST?

If you are running a business and your turnover is more than $75k, you need to register for GST.

Do I need receipts for all of my deductions?

Yes you do. For a full list of records that you will need to keep during the financial year, click here.

The good news is, there are now several Apps available that will integrate with your accounting software to help you keep electronic records of receipts.

Do I need to pay super for my employees?

If your employees earn more than $450 per month (before tax), or more than $350 per month if they are a housekeeper or nanny, then you do need to pay them superannuation.

There are consequences for not paying your employees super including fines or they can be charged with fees and interest. Employers who don't pay employees super also risk losing their tax deduction for super contributions.

When is my BAS due?

If your GST turnover is less than $20million then your GST reporting and payment cycle will be quarterly.

When lodging via a tax agent, the following dates apply for quarterly reporting:

- For July, August September quarter – BAS due date is 28 October

- For October, November, December quarter – BAS due date is 28 February

- For January, February, March quarter – BAS due date is 28 April

- For April, May, June quarter – BAS due date is 28 July.

I need some help with my accounting software (Xero, MYOB, Quickbooks etc.), who can I speak to about this?

We have extensive knowledge of the leading accounting software and we are always happy to help our clients out if they have administrative questions or get stuck. If we cannot solve the problem from our end we can advise you of the next best step.

If you are not currently working with Wrights, we suggest you access the software providers Help function, they are generally very responsive and helpful.

What would make the ATO want to Audit my business?

Things the ATO looks for things such as over or underclaiming on GST, being outside of your industry benchmarks and more. In our experience, once a business has been audited once, it tends to attract interest for future audits.

How much do you charge for your services?

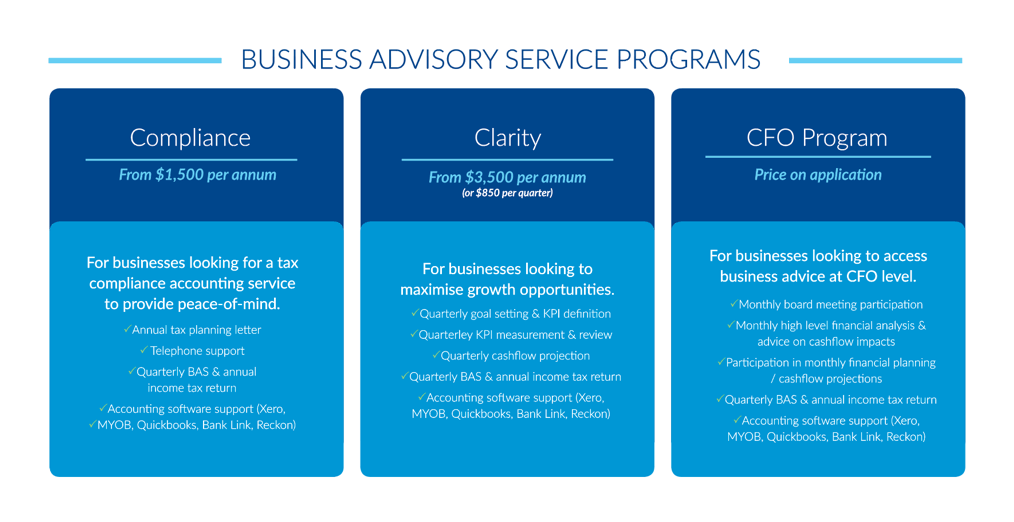

We have three levels of business advisory services that businesses can choose to access depending on the size of their business and the advice that they require. Please refer to the table below for more details about each service level.

You can read more about the services we offer here.

We do also charge an hourly rate for professional advice and additional services. Once we understand how we can help you, we can provide you with a more accurate scope of work and associated investment.

Why should I choose to work with Wrights Chartered Accountants?

- We're accessible and contactable. If for some reason we can't answer our phone or email immediately, we will respond to you within 24 hours of having received your contact.

- We consider the future. We help you realise your personal wealth goals by optimising your business financials.

- We are a strategic business partner. We immerse ourselves in your business so we can tailor customised solutions to meet your individual needs.

How can I make an appointment to see one of your accountants?

The easiest way to book an appointment with one of our team is to call our office on 02 6566 2200. Alternatively you can email us at admin@wrightsca.com.au. Your first appointment with us is obligation free.

How much tax do I have to pay if I sell my rental property?

- This will depend on the following detail:

- How long you have owned the property for

- Whether you own any other properties

- Whether the property is in your name only or in joint names

- What you paid for the property

- How much you expect to sell it for

- Whether you've ever lived in the property

All of these considerations are complex and do require further professional advice.

How can I get a copy of my financials to provide to the bank?

To get a copy of your financials, please call our reception 02 6566 2200 or email admin@wrightsca.com.au and one of our team will organise this for you.

How many phone calls or emails do I get with my accountant as part of my advisory service?

We are always happy to assist our clients with general enquiries concerning software problems or if they have questions concerning minor tax concerns. If your query results in additional work to be completed we will advise you of this at the time and provide a quote for this additional

What is an SMSF?

Self-Managed Superannuation Funds (SMSFs) are a legal tax structure, regulated by the Australian Taxation Office, with the sole purpose of providing for your retirement.

If you set up a self-managed super fund (SMSF), you're in charge – you make the investment decisions for the fund and you're held responsible for complying with the super and tax laws.

Six key questions you should ask yourself before setting up a self-managed superannuation fund.

- Why are you looking to establish a SMSF?

- How much money do you need to start your SMSF?

- What Trustee structure will you utilise?

- What is your investment strategy?

- Do you understand your obligations and responsibilities as a SMSF trustee?

- Do you have the time and skills to run your own SMSF?

Running your own SMSF is complex. Carrying out the role of Trustee or Director imposes important legal duties on you, and you need to ensure the money is used only to provide retirement benefits. You also have to keep comprehensive records and arrange an annual audit by an approved SMSF auditor.

Can an SMSF borrow?

Yes, however there are many legal and practical issues that need to be considered.

How much does it cost for an Audit?

Once we understand the full scope of your audit requirements, we are able to provide you with a quote for our services.

When can you have my Audit completed?

We generally work on a turn-around of three weeks. We generally work it back from the date of your Annual General Meeting. Smaller audits will take closer to two weeks.

Liability limited by a scheme approved under Professional Standards Legislation